Travel Insurance – A Must Have or Unnecessary Cost?

There are as many opinions about the necessity of travel insurance and who the best travel insurers are as there are travelers.

Some people – usually young, fit, and healthy, on super-budget flights with minimal possessions – feel travel insurance is unnecessary and the money better spent on something fun.

Whereas other travelers would no sooner set off without the highest level of cover than chop off their right hand.

And there are infinite shades of gray in between those two extremes.

We regularly reevaluate our risks when traveling, against our budget to choose the best option at the time we renew our policy.

Bottom line. Each person needs to consider their risk appetite and obtain a level of travel insurance they feel comfortable with, whether that be none, some, or total protection.

Travel Insurers

Due to financial services legislation around the insurance industry, we cannot recommend a specific insurer or policy. (Although, if you read our disclosure at the bottom of this page, you’ll see we only add companies to this website with good reason.)

Instead, we will:

- Explain the reasons we have travel insurance

- Provide links and travel insurance quote tools so you can easily research the best policies specific to your needs.

- Tell you about the times we’ve needed our travel insurance company and how it turned out.

- Tell you why we regularly review our Travel Insurance Options

- Provide more details on the company we currently use for Travel Insurance. (August 2023 – October 2023)

- Provide some tips for:

- Finding the right travel insurance policy

- Preparing for the worst should you need to use your Travel Insurance.

Don’t want to read anymore and just need a travel insurance quote:

We are partners with the following Travel Insurance companies. (See our disclosure statement at the bottom of this post.)

SafetyWing

- Covers most nationalities

- Buy abroad, stay abroad

- Continuous coverage for multiple countries

- Visits to your home country are covered

- Young children are included free of charge

- Medical – Medical Assistance for accidents or illness outside your home country.

- Travel – Coverage for travel delays, lost checked luggage, emergency response, natural disasters, and personal liability.

Cover-More

- Only for Australians

- Three levels of Cover – International Basic, International Comprehensive and International Comprehensive Plus

- COVID-19 cover

- Medical

- Luggage Delay

- Pre-existing conditions cover available

- Trip cancellation cover

- Rental Vehicle Excess or Comprehensive Cover

World Nomads

- Covers most nationalities

- Buy travel insurance while already traveling

- 24/7 Emergency Assistance by a multi-lingual assistance team

- Travel Cover for 220+ Adventure Activities

- Trip Cancellation

- Emergency Medical Overseas

- Emergency Medical Transport

- Cover your stolen or damaged gear and tech

Visitors Coverage

- Covers most nationalities

- Partnered with the world’s top insurance underwriters

- Offers hundreds of tailored policies

- Complete range of travel medical insurance and trip insurance solutions globally

- Top-rated Customer Service team

- Simplified purchase experience — quote and purchase in less than 5 minutes

Reasons We Have Travel Insurance

1. Medical Evacuation – Medical care is very basic or practically non-existent in many places we visit. You might ask why the hell we would want to go to these destinations, but that’s another story. The fact is we do. And we are very aware that if we are hurt or get critically ill, we’ll need to get evacuated somewhere we can be treated as soon as possible.

2. Medical Costs – If there is “International standard” medical assistance in a destination, it’s usually quite expensive to access. We can budget for insurance policy premiums with no problems. But we’d be stuffed if we had to come up with $10 – $50,000 or more because we didn’t have insurance. Don’t even talk about the price of medical treatment in the USA. Ouch!

3. Theft/Loss of possessions – Despite traveling cheaply, we are considered wealthy in many developing countries. While we have never had anything stolen and are extremely careful with our security, our cameras, computers, and other bits and pieces are worth more than many people’s monthly or annual salaries. 99% of people in most countries are honest and wouldn’t dream of stealing despite being so poor. However, there is always a minority who wouldn’t hesitate to give in to temptation. One slip, and our stuff is gone. To replace them would be expensive and put a big dent in our travel budget. NOTE: not all policies include theft.

4. Cover for Risky Activities – We like to push the boundaries when we travel. Yes, that road/bus/boat looks a bit dangerous, but our experience will be worth the risk a thousand times. We’ve helped sail a yacht across the Caribbean and been skydiving in New Zealand. We both have open-water diving licenses and often hire a small motorcycle to travel around country roads at our own pace. And now we’re into long-distance, self-supported bicycle touring. All of these activities have inherent risks, and we’re prepared to take them to have new experiences, but it’s nice to know if things do go wrong, we have support.

5. Trip Cancellation/Disruption – Is it just us, or do you, too, feel the airline industry is currently in chaos? Cancelled flights, airport disruptions, and lost and damaged luggage. To date, we’ve never had an issue, but it’s comforting to know that if there were an extensive disruption to our plans, we would be compensated to some extent.

Our Personal Experience With Needing Travel Insurance

Extreme Abdominal Pain.

It was pretty scary when Tim got a kidney stone in Vietnam in 2014. I’m not sure if you’ve ever had a kidney stone yourself, but the pain can be pretty intense. And if you don’t know what the problem is, your imagination can run wild. I immediately contacted our travel insurance company at the time, Cover-More for advice on what to do and where to go. They recommended one of the best (and most expensive) international standard health facilities in Ho Chi Minh City. To diagnose the problem required expensive imaging, and then they kept him in the hospital. But they wouldn’t even start the process unless I had a credit card with a hefty limit. From experience, this is the standard procedure in most countries.

The bottom line is that while Tim didn’t enjoy the kidney stone, our experience with Cover-More was excellent. They provided great support while he was being treated and gave us a full refund of all our costs, totaling 700 USD, without any argument. That amount of money goes a long way in Vietnam. But more importantly than the money, they were in regular contact during the process, genuinely concerned about Tim’s welfare and how I was coping. And they also followed up afterward to ensure the problem was resolved.

Angry Hemorrhoids

It’s not the most pleasant of subjects, but it’s real life. In 2015, we had just begun a 4-month sailing trip throughout the Caribbean on a 50-ft yacht. We had just completed an 8-day open-water sail from Bonaire to Grand Cayman, where we anchored up for a few weeks. It was a rough crossing; we were all tired and emotional. Imagine my horror when I discovered blood in my stools and had no idea why. Had I been injured during the crossing? Was it a symptom of something serious? We had paid the total amount for the four-month trip, and there was no way the captain would have refunded any of that. And the Cayman Islands isn’t the cheapest place to get medical treatment.

I immediately contacted our travel insurance provider, World Nomads, who gave us prompt advice on which medical facility to go to.

Thankfully, the problem was only ‘angry’ hemorrhoids. Something I’d neither heard of nor experienced before. The doctor reassured me that things weren’t serious and cauterized the offending bits to stop the bleeding, with advice to get things checked out further when I could. (Which I have since done, and all is fine.)

My experience with World Nomads was similar to our one with Cover-More. They regularly followed up to see if I was OK and promptly paid the claim (600 USD) despite the fact I had a hard time getting all of the required paperwork out of the clinic.

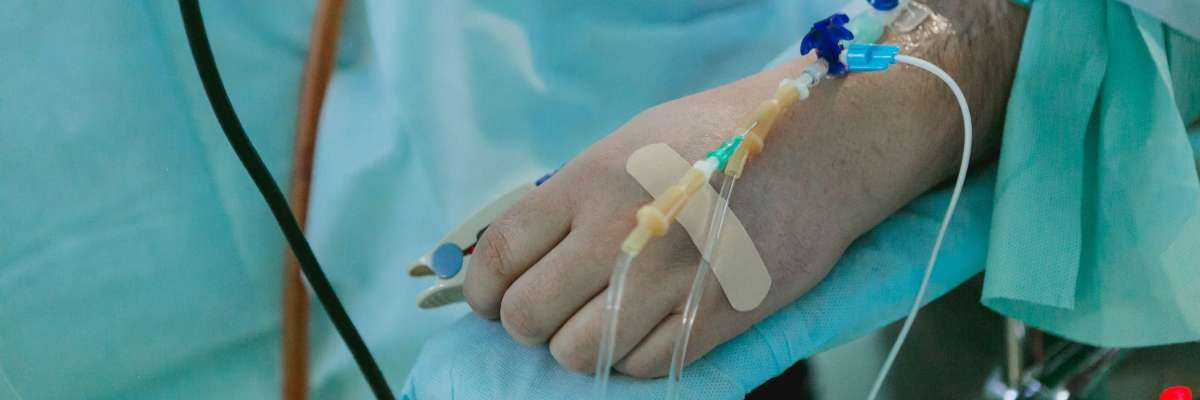

Abdominal Pain Resulting in 9-days in Hospital

Tim again. But this time, we were in Kuala Lumpur, and the tummy pain was a severe case of diverticulitis, an infection in the bowel that can result in sepsis and death if not treated. Yikes.

Once again, our travel insurer was World Nomads. And once again, they were brilliant.

When I contacted them, they recommended I get Tim to the best hospital in the City. Thankfully, it was just a short walk from where we were staying.

I initially had to stump up our credit card to get the diagnostics rolling. But, as soon as I gave World Nomads access to our medical records and they confirmed it wasn’t a pre-existing condition, they guaranteed all further payments to the hospital, which was an enormous weight off my shoulders. (See Our hints for Documentation below.)

The total bill ended up over $5000. Had Tim not responded to the antibiotics, he could have required surgery and maybe evacuation back to Australia, which would have been ten times that cost. And had we still been in the USA, that bill would have had at least one, maybe two zeros on the end. That’s a life-changing disaster and could have ended our travels permanently. Thankfully, it didn’t come to that, but I felt World Nomads had our backs if the need did arise. Their medical team was in constant contact with me to ensure things were on track and then afterward to make sure he was OK to continue our travels.

A Broken Arm

Three rides into our Vietnamese Cycling Tour from Hanoi to Ho Chi Minh City, I slipped on killer Vietnamese tiles at our small guesthouse in rural Vietnam and smashed up my elbow badly.

The logistics of getting me and my bicycle back to civilization and to a hospital is a long and tortuous tale, which you can read here. But the result was surgery in Hanoi’s International Standard French Hospital to add two titanium pins and wire to hold my elbow together, a few nights in the hospital, and follow-up trips and diagnostics to check the healing process—total cost: about 5000 USD. Our insurer at the time, World Nomads, sorted everything, including the payments to the hospital and refunds for the transport to get me to the hospital and check-ups. Once again, their advice, support during and after the event, and prompt payment made the traumatic events more bearable.

A Lost Bridge Requiring Surgical Implants

Tim again. Tim woke up one morning in Ho Chi Minh City, and the bridge holding two of his bottom teeth together was missing. Our dentist told us the best solution was to get two implants. A process that would take several months. Fortunately, we temporarily resided there and proceeded with the treatment. COVID hit, so there were further delays, but the total process cost was about 3500 AUD. Our travel insurer at the time, Cover-More, paid for all of the treatment that occurred during the life of the policy, which was about 60% of that. This was a trickier one to claim as they had to get advice from experts in Australia to confirm that the implants were necessary. But once they finally got a response, payment was prompt.

Why We Regularly Reevaluate and Change Our Travel Insurance Company.

- Departure Point – Most Travel Insurance companies will only provide cover if you leave and return to your country of residence. For example: Cover-More. So, if we depart from Australia at the start of the policy, Cover-More is an option. But because we travel full-time, that’s only sometimes the case. Companies like SafetyWing and World Nomads will provide cover while you are already traveling.

- Price – Every year we get older, the price of cover goes up. It always pays to get a quote to get the best value. This is one of the reasons we took out cover with SafetyWing this time. Our Cover-More policy expired, so we needed travel insurance for a couple of months until we will return to Australia. SafetyWing was marginally cheaper compared with similar options.

- Pre-existing conditions. Now that we’ve had the above medical issues, some companies will NOT cover them under any circumstances. Others will provide cover if they haven’t occurred for a specific period or you pay an extra premium.

- Planned Activities. Some policies specifically exclude risky activities. Other companies include many of these activities for free and will add others for an extra premium. For example, we paid extra to be covered on our sailing trip in the Caribbean as we were more than 3km offshore for a good part of the trip. It was more expensive, but well worth it in our opinion if anything went wrong. I also pay extra to ensure I am covered to ride a motorbike. (I have a valid Australian and international motorcycle license.)

SafetyWing – A New Type Of Travel Insurance for Digital Nomads and Long-Term Travelers

SafetyWing is a new kid on the block in travel insurance for long-term travelers. Their policies are especially attractive for younger digital nomads who want to avoid paying for a 12-month policy upfront.

The things we liked before signing up with them:

- Two simple choices for coverage – Worldwide excluding the USA OR Including the USA. It is nice to know they recognize that many other countries have reasonable healthcare.

- Automatic recurring four-weekly payments up until 12 months, when you need to renew your policy. This means you have no substantial upfront bill. If you go home early, you don’t forfeit a lot of money, as you can stop anytime. By signing up for a new policy, you can also flick between the US-included and not included as needed. If you’re only going for a month in the middle of your trip, this can save you hundreds over a 12-month policy that includes North America. Note: You don’t have to take this regular payment option. As with other travel insurers, you can still buy a policy for a set period.

- Travel Insurance validity if we need to return to Australia unexpectedly – Compared to other companies we’ve explored, Safety Wing has a longer period that you can return home for incidental purposes – eg. weddings, parties, anything. Every 90 days you are insured, you can be home for 30 (15 for Americans). By comparison, other policies may only let you go home once and end the cover if you return home for a second time within the policy duration. Or, if you have a single-trip policy and not an annual multi-trip policy, the policy may automatically expire once you return home. You would need to purchase another policy if you resume your trip.

Please keep in mind that if you have returned early from your trip, you CAN sometimes submit a request to refund a portion of the remaining period of insurance.

Tips for Choosing a Travel Insurance Policy

- Choose a travel insurance company with a good reputation that has been around for a long time. You don’t want your insurance company to go under while you’re on the road, or you might be stuck with no cover.

- Read customer reviews (not just those the insurer promotes on their website!). You have to read between the lines, though. The rules are pretty clear on making claims, and some people will definitely try and push the boundaries and then whine if they’re unsuccessful. I find Trustpilot a good source of independent reviews.

- Read the policy to know what is and is not included. Clarify anything you are not sure of in writing BEFORE you go… Motorbike riding and sailing in international waters are just two things I’ve clarified. Eg. Even though I have a motorcycle license in Australia, I would not be covered in Vietnam UNLESS I had a valid Vietnamese license. The reason is that neither Australian nor the usual International licenses are recognized, and I would be riding illegally. And yes, I did obtain my Vietnamese motorcycle license while we were there, as the potential for injury in the crazy traffic is very high. In Sri Lanka, to drive legally, we had to have my IDP validated at the Sri Lankan Automobile Association. It took 15 minutes and about $30; small fry compared to driving illegally and then getting injured (or injuring someone else!!) without cover.

- Make sure you have a policy that includes your destination. We travelled for around 12 months in Asia with five weeks in Japan which usually attracts a higher premium. We clarified with Cover-More in writing if we were covered by the Asian Policy even though we were visiting Japan because the majority of our time was in other countries in the lower band. Some travel insurance companies won’t cover nationalities in some countries AT ALL!! For example, last time I checked (and this may have changed) SafetyWing won’t cover anyone visiting Cuba, Iran, or North Korea. World Nomads and many other companies also have similar exclusions for North Americans, although Aussies are quite OK to visit Cuba. Covermore will insure Australians for all of those destinations. But you need to check! These things change all the time.

- Make sure the travel insurance company offers 24-hour assistance with a free call number from overseas. I do not want to wait for “office hours” to kick in before I get some action. By the time I got home from the hospital in Ho Chi Minh City when Tim had the kidney stone, it was midnight in Australia. I still got an exceptionally professional, caring, and helpful response from the international contact line.

- Make sure you understand what possessions are covered by your policy. Itemize any special items of extra value and pay the additional premium if necessary. The last thing you want is to have a disappointing exclusion or be out of pocket if the worst happens.

“NO INSURANCE COMPANY WILL COVER YOU FOR DOING SOMETHING ILLEGAL. (Even if you didn’t know it was.)”

Once You’ve Taken Out Your Travel Insurance Policy

- Copy your policy and give it to at least one or two trusted people. That way, they can provide the information if you lose your copy or cannot provide it because you are incapacitated. Keep the details of these contacts somewhere they can be found if you’re unable to. I send our policies to my sister. She is our emergency contact in our passports and our phones. It’s also a good idea to give traveling companions or tour companies a copy of your policy and emergency contacts. If you are out of action, at least they can initiate contact with the company.

- For Australians – Activate a MyGov account and link your Medicare records before you go. That allows you or your travel insurance company to access your medical records online and satisfy any questions about pre-existing conditions. If you visit a medical practitioner or facility while traveling, scan and keep those details somewhere safe, but where you can access them if required.

- Ensure you have a list of stuff you take on your holiday, including any receipts, where possible. That will make any claims so much easier.

- If something happens and you think you might need to claim on your policy, contact the insurance company ASAP. Ask which clinic or hospital to attend if it’s a medical issue. Get their advice on what to do if it’s something else. In our experience, the earlier you get them involved, the more likely your claim will succeed. They are unlikely to refuse you if you’ve followed their advice and instructions.

- Ensure you contact the police if anything gets stolen. Don’t believe they will help recover anything for one minute, but you MUST get a police report detailing the event to make a successful claim.

- Remember – insurance is for the unexpected. Claim everything you are entitled to, but don’t abuse the system. It just makes premiums more expensive for the rest of us.

Handy Tip: Did you know you can add your emergency contacts and details to your phone? When you add details as an ‘Emergency Contact,’ they can be accessed without needing to log into your device. You can add your policy number, emergency phone number for your insurance company, blood type, and any allergies. Here’s a video on how to set that up.

Our Final Word on Travel Insurance

So there you go—our tales of woe and thoughts on travel insurance. Ultimately, deciding whether you need it and what type to buy is up to you.

We wish you all safe and rewarding travels and sincerely hope you never need to make a claim.

But if you need a travel insurance quote right now, check out our partners below.

SafetyWing

- Covers most nationalities

- Buy abroad, stay abroad

- Continuous coverage for multiple countries

- Visits to your home country are covered

- Young children are included free of charge

- Medical – Medical Assistance for accidents or illness outside your home country.

- Travel – Coverage for travel delays, lost checked luggage, emergency response, natural disasters, and personal liability.

Cover-More

- Only for Australians

- Three levels of Cover – International Basic, International Comprehensive and International Comprehensive Plus

- COVID-19 cover

- Medical

- Luggage Delay

- Pre-existing conditions cover available

- Trip cancellation cover

- Rental Vehicle Excess or Comprehensive Cover

World Nomads

- Covers most nationalities

- Buy travel insurance while already traveling

- 24/7 Emergency Assistance by a multi-lingual assistance team

- Travel Cover for 220+ Adventure Activities

- Trip Cancellation

- Emergency Medical Overseas

- Emergency Medical Transport

- Cover your stolen or damaged gear and tech

Visitors Coverage

- Covers most nationalities

- Partnered with the world’s top insurance underwriters

- Offers hundreds of tailored policies

- Complete range of travel medical insurance and trip insurance solutions globally

- Top-rated Customer Service team

- Simplified purchase experience — quote and purchase in less than 5 minutes

Disclosure: Note that some of the links and advertisements on this page lead to products from our partners. If you buy something after using those links, we may earn a small commission from the sale. However, you have our assurance that you won’t pay any more than you would by buying directly from their site. And we promise to only link to products or companies we’ve used personally, been recommended by trusted family, friends, or travel buddies, or researched thoroughly before adding them to the list. You may also see other links served to you by Google. These will display products that Google thinks you want to see. If you click on those advertisements, we also get paid a small (minuscule) amount. If you want to know more about how you help to fund our travels without costing you a cent – then CLICK THIS LINK for a more comprehensive explanation.